Freedom Debt Relief - Low Debt Enrollment

Freedom Debt Relief helps people with their debt above $7,500 in a quicker and less expensive way.

Low Debt is any amount below $7,500 and above $1,500. The company will only break even at this amount.

NOTE: This project was released after I left the company. Designs shown here are the ones I participated in and closely resembles the released version.

Background

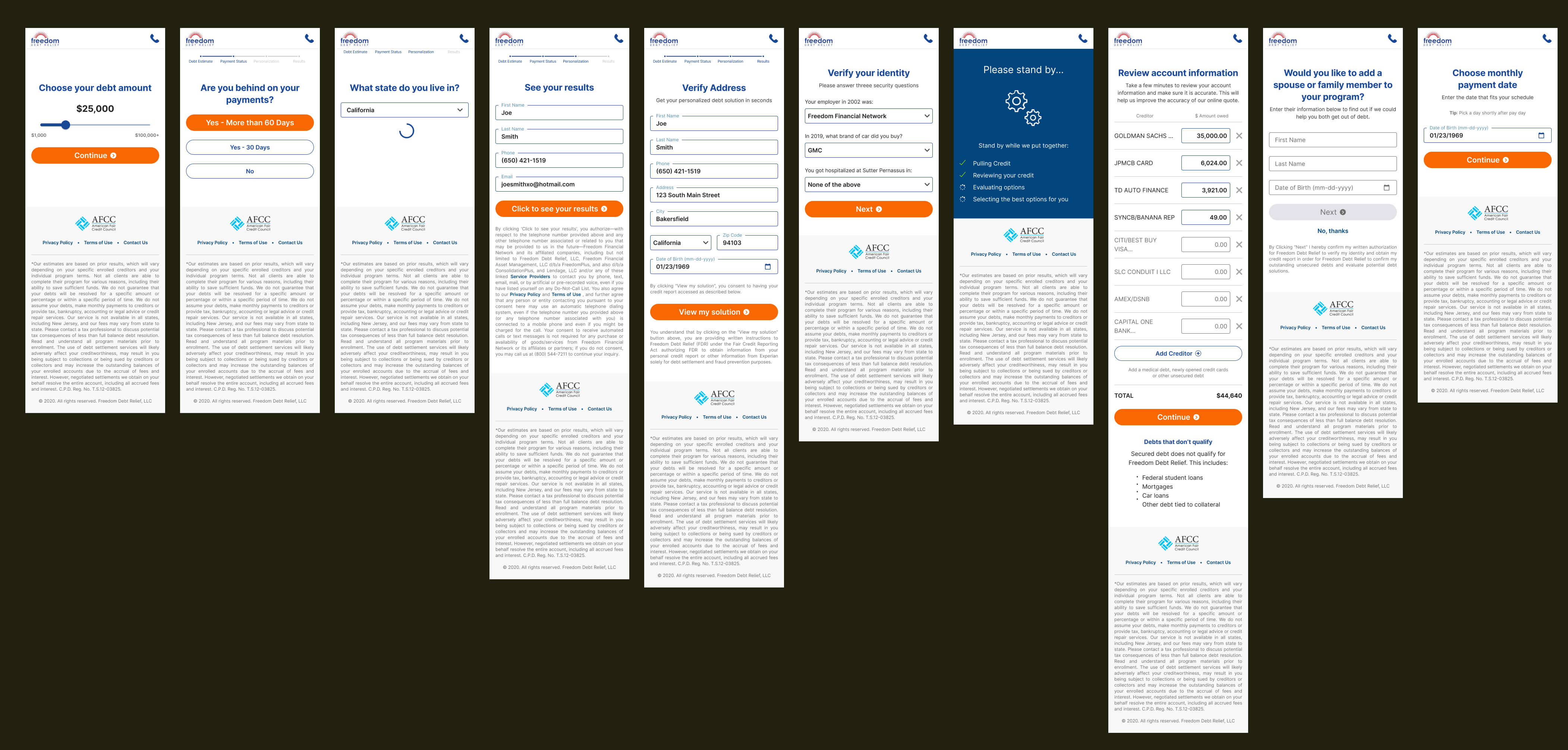

Every new customer of Freedom Debt Relief goes through our standard lead flow to assess the right solution for them.

BUSINESS PROBLEM:

Low debt leads were sold to 3rd party company to resolve them

How might we enroll low debt prospects into our program?

Validate a fully digital end-to-end experience without any human interviention

CONSTRAINTS:

Due to time and resources, there will be no registration or account creation to save their progress. In the background, their progress will be saved via cookies and will be emailed/texted to them

Retain visual design from Lead Flow

Minimum information to present and collect are mandated by legal team

People Problem

SURVEYS & FEEDBACK BUTTON: Users expressed that they did not want agents to call them to enroll them to the program

People with lower debt still need help to get it resolved and express their dismay when we turn them away

The amount of information needed to absorb about the program and the information to enter is tremendous

Discovery

Persona

Users with debt below $7,500 but are incapable of paying

In high stress

Has income but unable to pay the minimum amount

Objective & Key Results

OBJECTIVE:Task Success — with the amount of information to expose and gather, our aim is for a user to successfully complete and send their application and enroll into the program.

KEY RESULT:10% completion/enrollment

OBJECTIVE:Validate a fully digital experience with the "Tiny Rewards" approach and learn how the user adopts this design.

KEY RESULT:50% click through from the 2nd reward page.

Solution Ideation

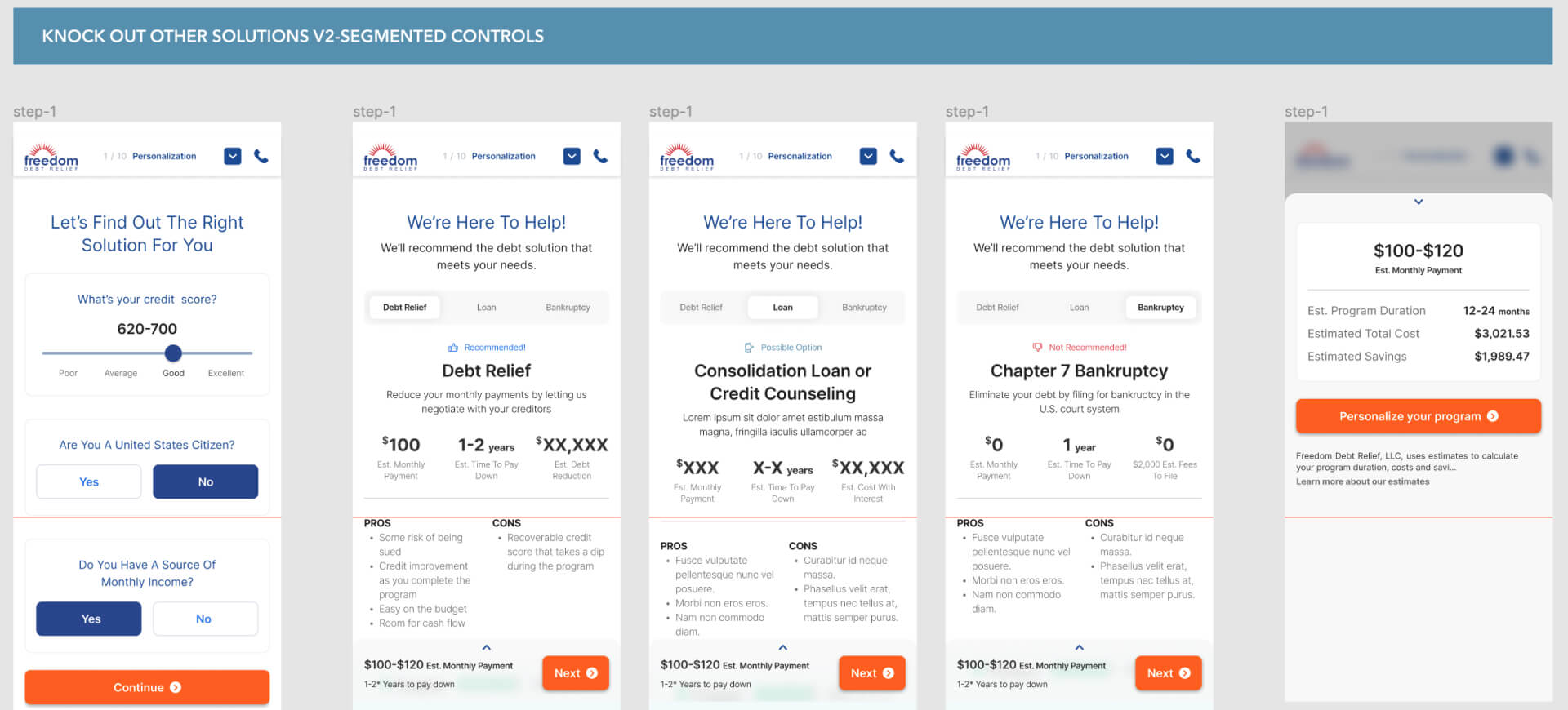

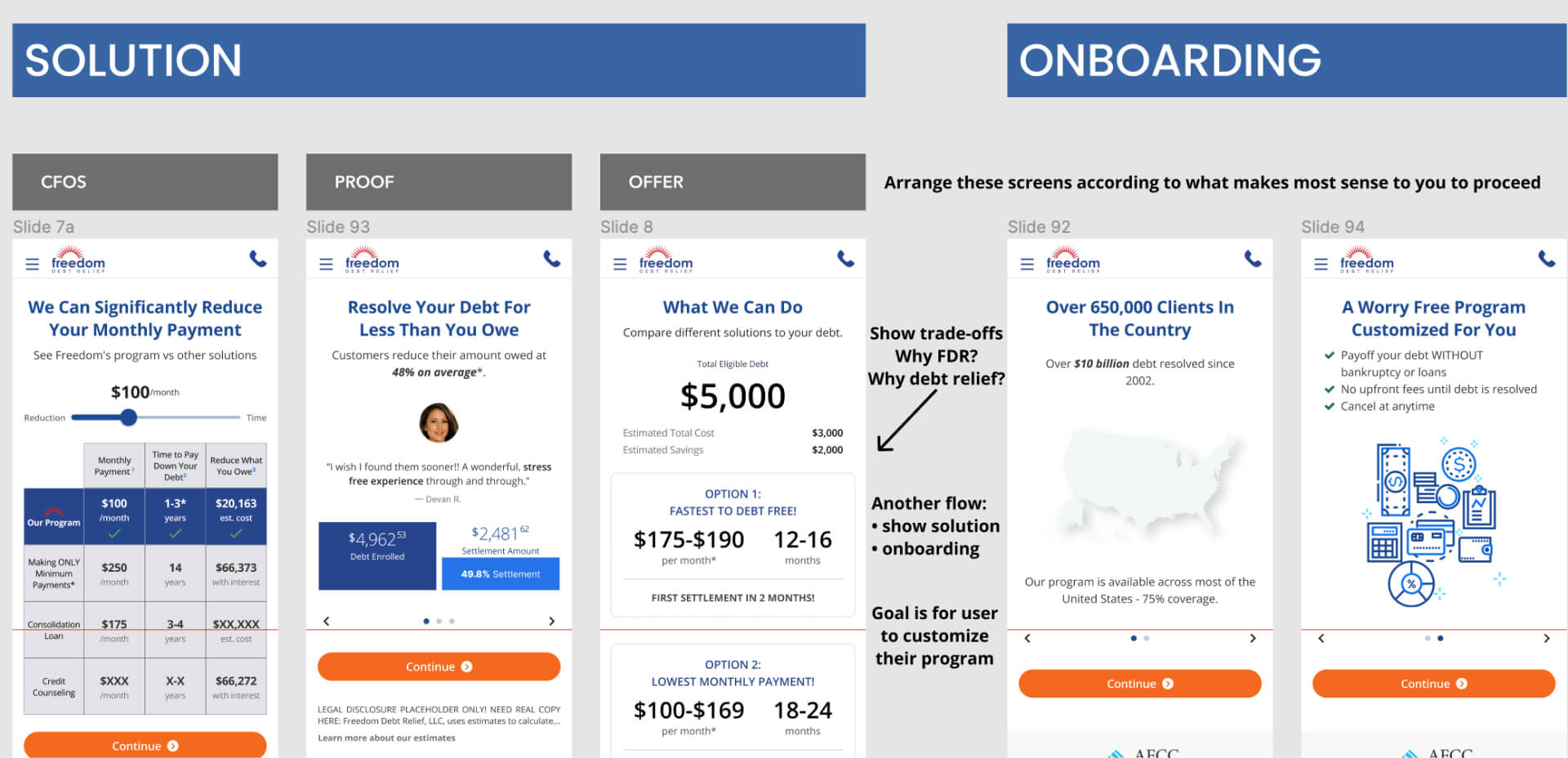

We tried different approaches to solve this challenging design problem.

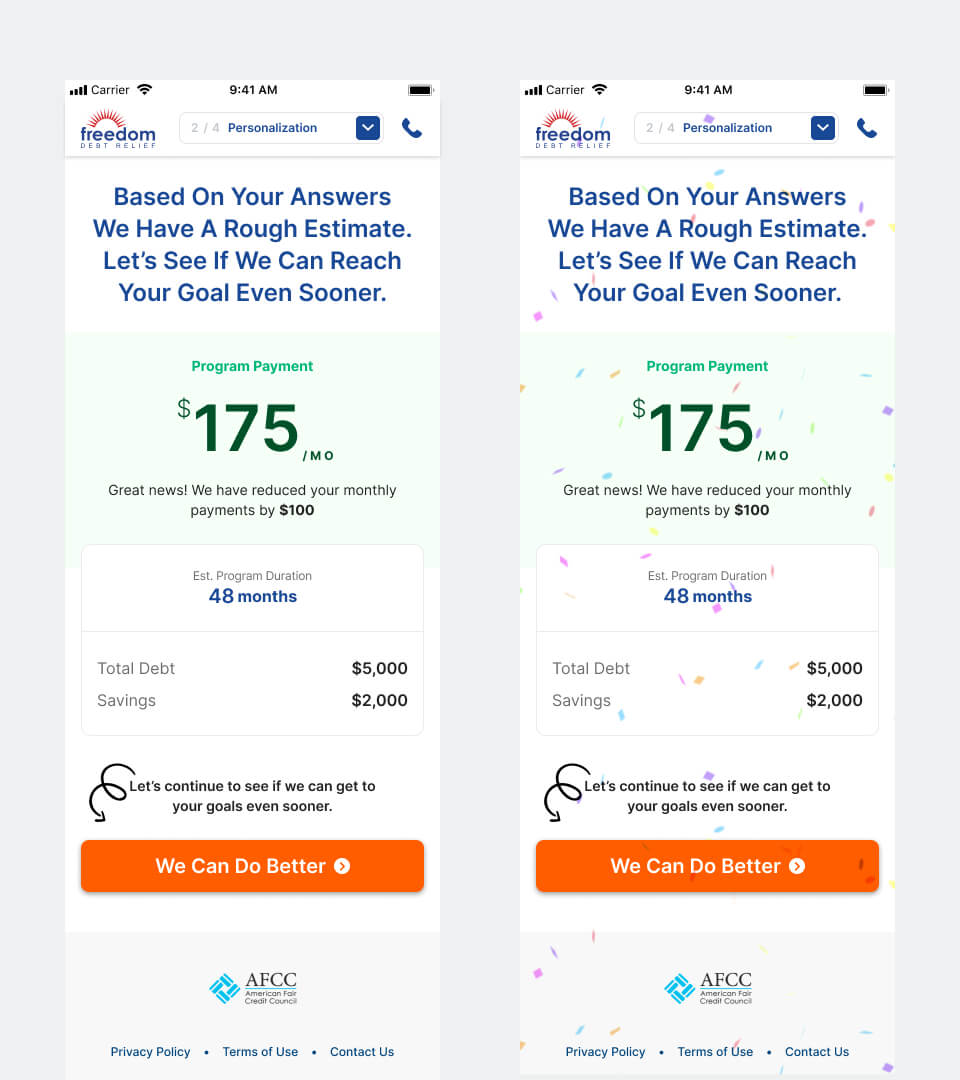

VERSION 3: Tiny Rewards

Inspired by Noom, we also tested this approach of slowly improving our solution offering to the user as they continue to enter required information for enrollment.

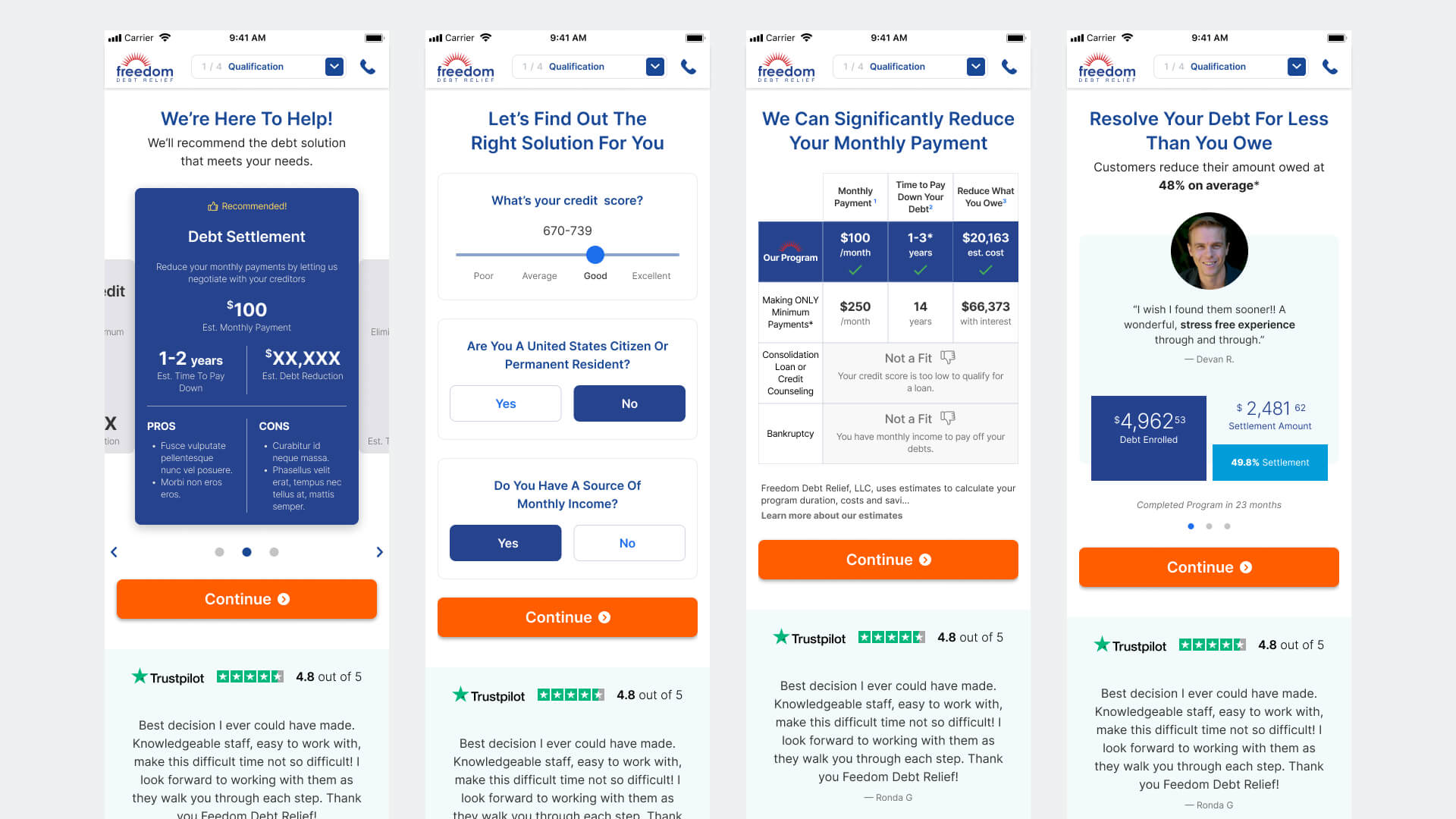

We immediately begin to show you the solution to be transparent about your options, it's pros and cons as well as success stories.

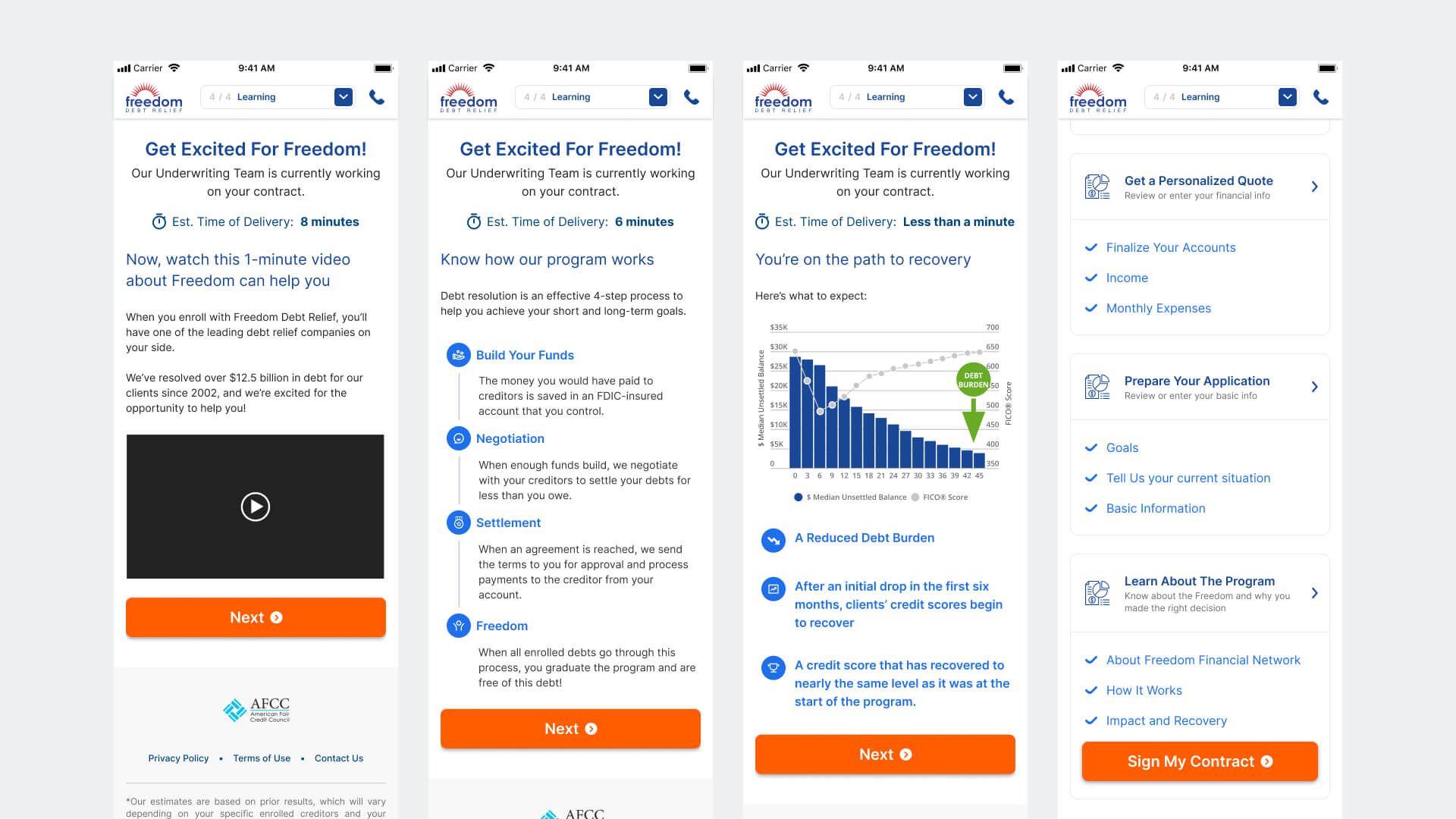

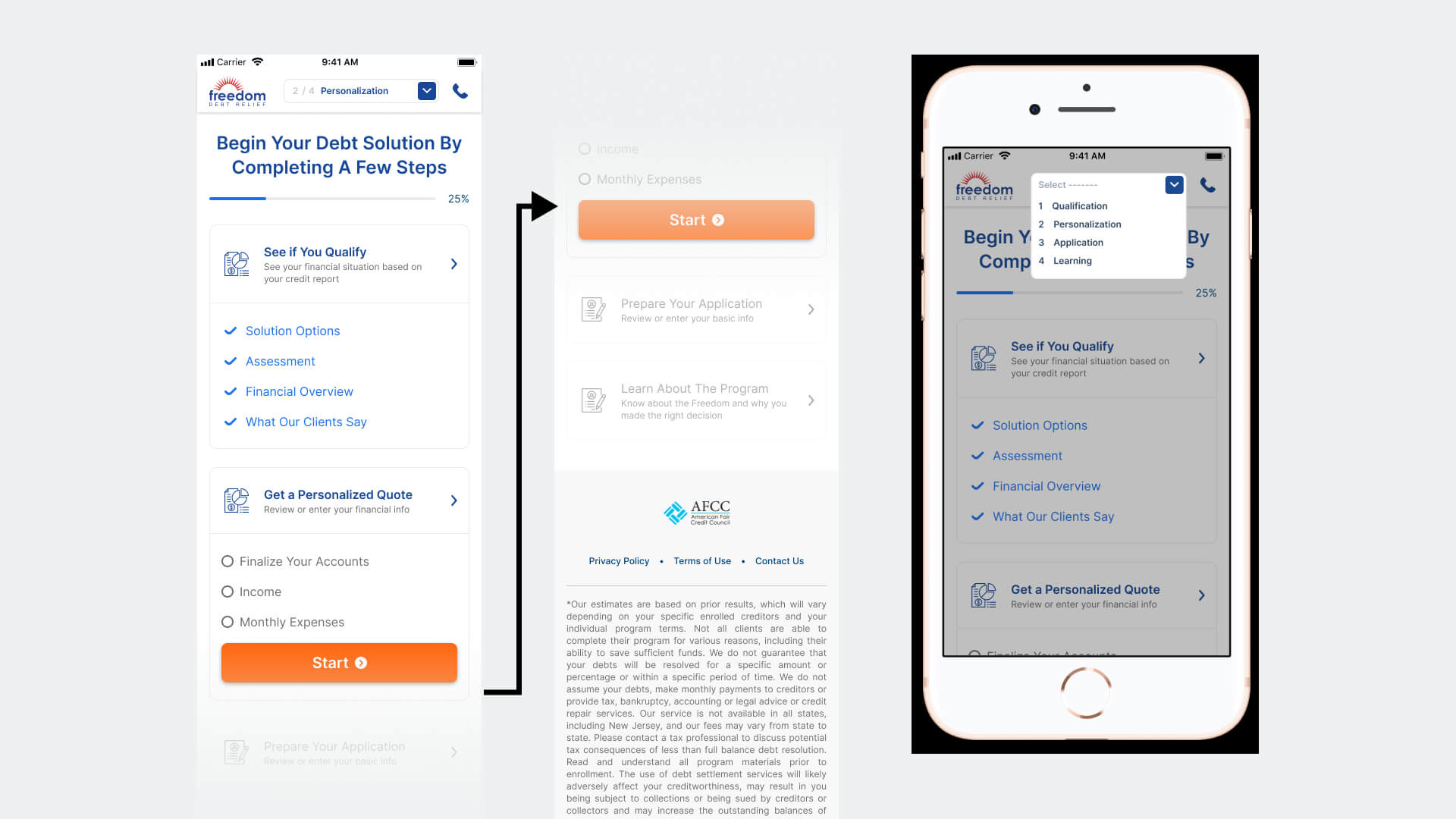

You then arrive on your dashboard where you see your progress: what you've accomplished, what step you're in and what you more you need to do. We also added a dropdown navigation in the header for quicker access to the different sections.

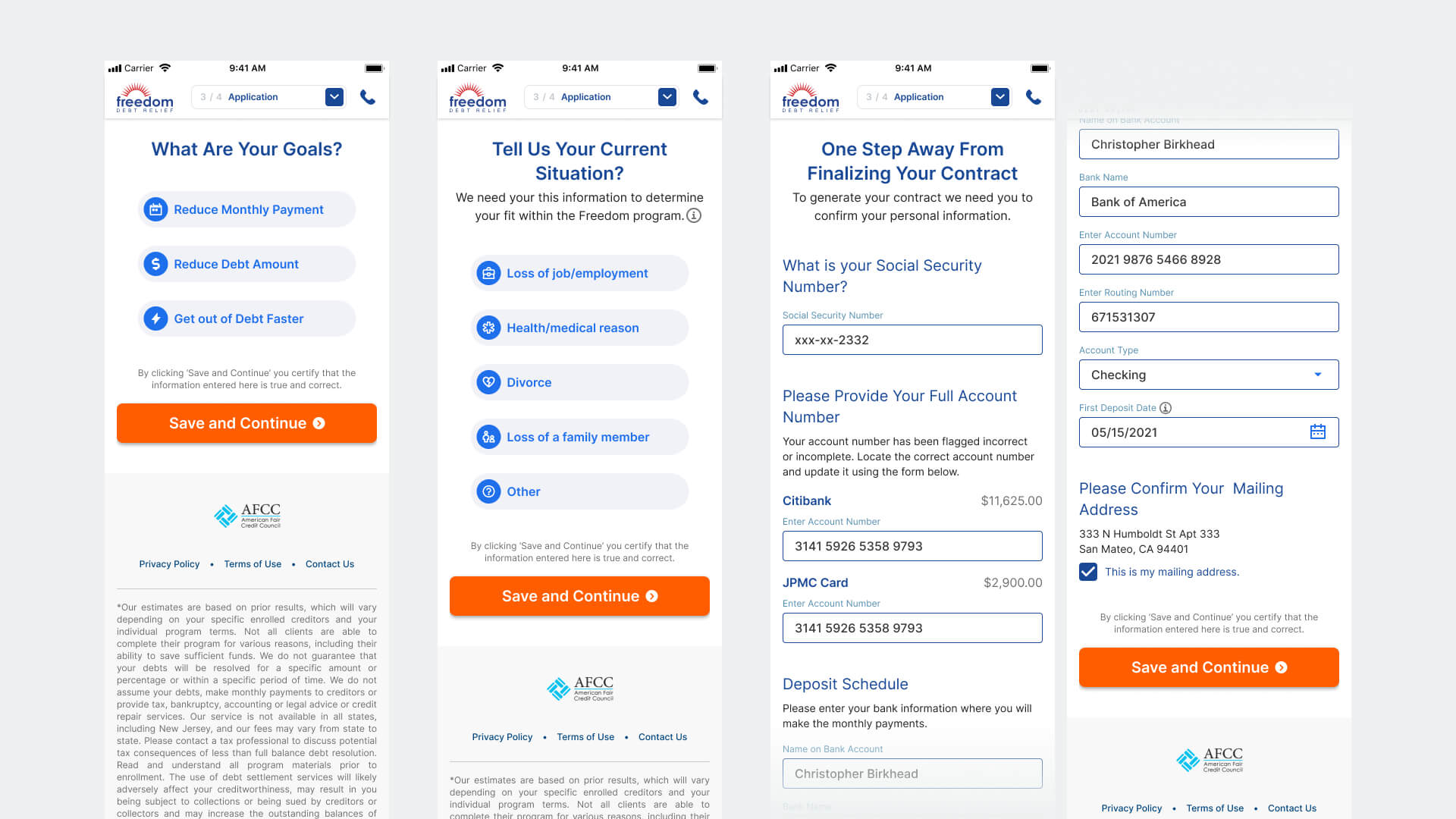

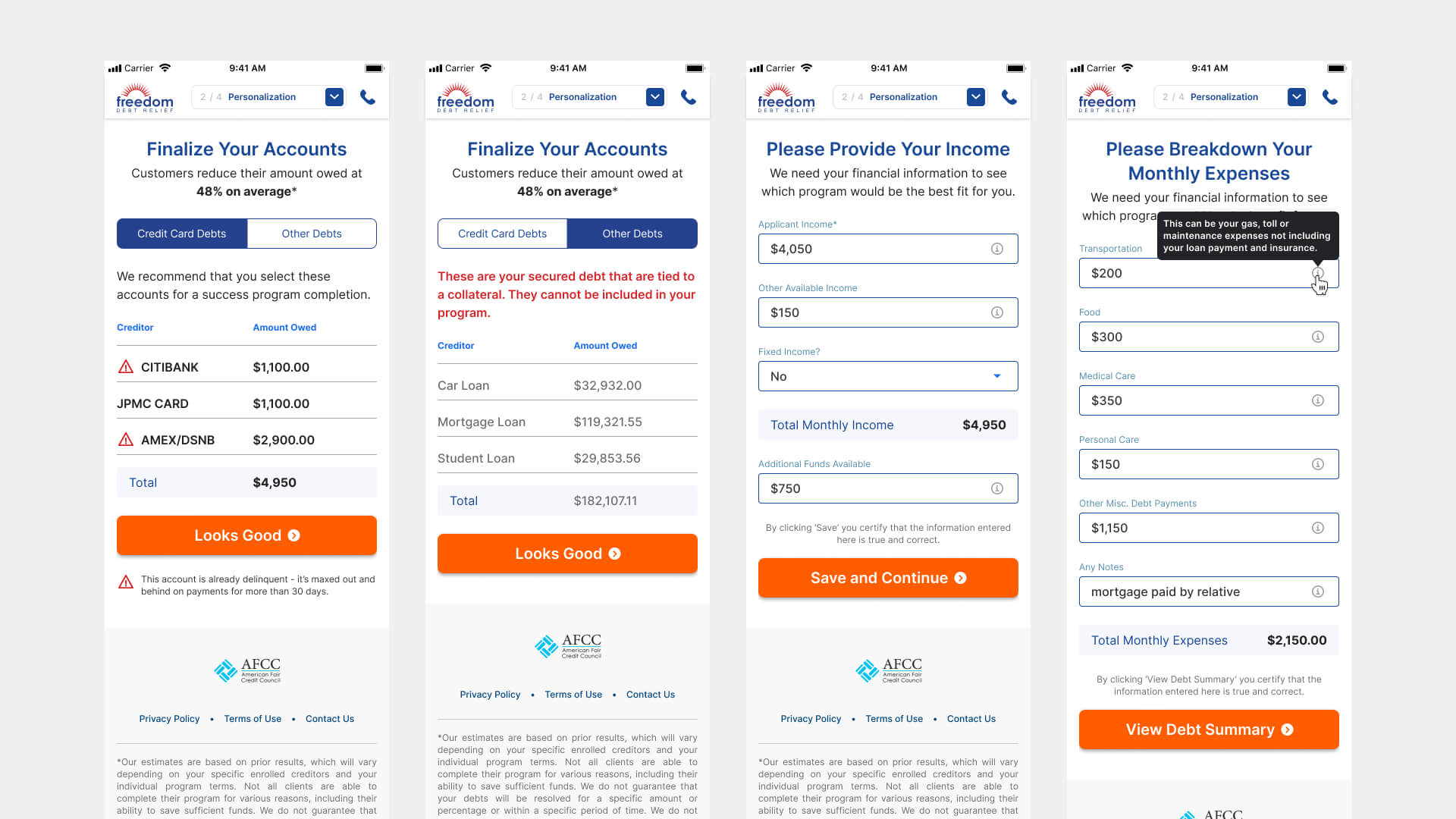

The next set of steps requires you to review your debt and enter some basic personal questions. For each entry, we provided a tooltip button to help you enter the answer correctly.

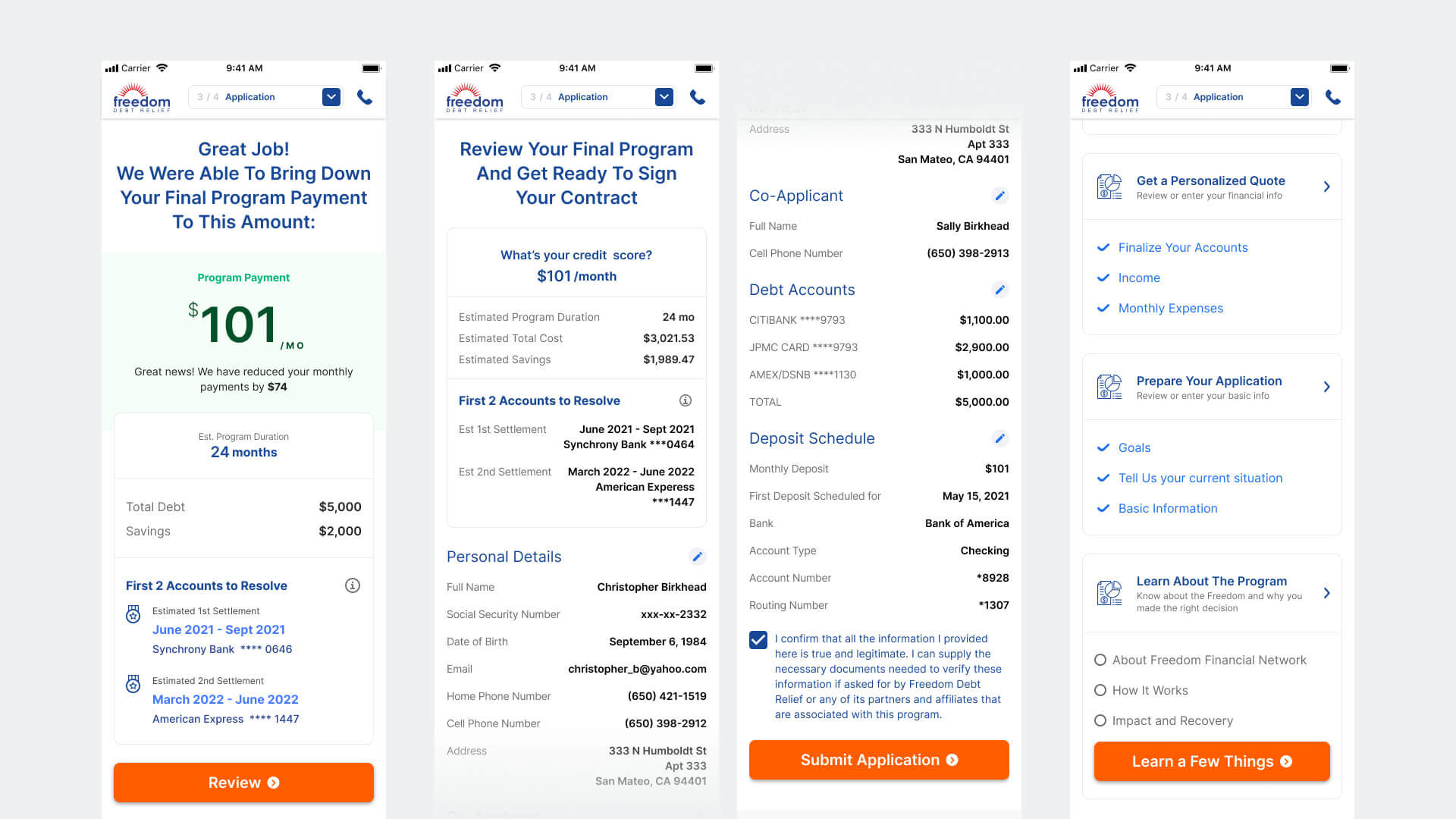

After getting the monthly payment down further, we are also able to show you the first 2 credit card accounts we can resolve within the next few months.

We then ask the user to review all their information before they submit it to generate their contract.

As our back-end system generate the contract and our Underwriting Team prepares it, we ask you to learn more about the program and our company. It takes a few minutes to generate the contract.

Prototyping

This was our mobile prototype for user testing and initial release.

Our hypothesis was by applying the tiny rewards, our customers will be more invested and hooked into finishing their program enrollment.

Results

This project was released shortly after I left the company. I remained in touch with the team to keep updated with the results:

In 1 month, we reached statistical significance with an incredibly low adoption rate of 2.8%, missing our target of 10%.

78% of our successful enrollments returned using the email link we sent them after ending a session. They returned on an average of 2 days after initial session.

Key Learnings

The team received some good feedback from our user research surveys on the "tiny rewards" approach. However, the complex nature of the enrollment process is still a big factor and needs more tests and iterations to improve adoption and task success.

Some notable learnings include:

One of our goals was to validate a fully digital enrollment experience - we learned that this is extremely challenging given the amount of information the user goes through.

"Tiny Rewards" is a valid approach as 84% of users who completed the enrollment clicked through the 2nd reward page.

Users need to create an account to assure them that their progress is saved and they can return to it whenever they can.

Robby Torres / Product Designer

Robby Torres / Product Designer